Check out the first part of this series exploring the rise of fintech in the Middle East with a focus on the financial ecosystems of the UAE and Saudi Arabia.

The Middle East has witnessed considerable growth in the fintech sector and the number of fintech startups is estimated to double from 105 in 2015 to 250 in 2020. In the last decade, fintech startups in the region have raised more than $100 million in funding and this amount is predicted to double by this year. In 2017, disclosed investments doubled to over $35 million from $18 million the previous year, largely due to PayTabs’s (Saudi payment processor) successful fundraising of $20 million that year.

Fintech & Financing in the Middle East

Investment in the Middle East’s fintech sector via venture capital is expected to grow to 2 billion dollars in 2022 to fund about 465 startups.

Dubai, the largest fintech hub in the Middle East, has established the Dubai International Financial Centre (DIFC) to spearhead innovation & development in the fintech sector. In 2017, it launched a $100 million fintech-focused fund to accelerate the development of financial technology by investing in startups from incubation through to scale up stage. In 2019, DIFC announced that its fintech ecosystem had grown from over 80 companies to 200 companies, while the number of licensed fintech firms operating in the DIFC increased from 35 to more than 80 in the first half of 2019. The DIFC currently boasts more than 671 financial related firms, an 11% increase from the same period last year.

The UAE houses 46% of the fintechs in the Middle East, and accounted for 47% of all fintech deals in the region in 2019. The country has received more than $237 million in funding in the last five years — there have been 181 deals made since 2015, with over 50 deals in the first half of 2019 alone. Payments and remittances accounted for 45% of these deals.

In Qatar, the government revealed that a fintech strategy plan is in the works, complementing the Qatar National Vision 2030 framework. This includes the launch of digital banks, financial services offered through mobile applications, and more.

The Saudi Arabian Monetary Association (SAMA) launched Fintech Saudi to develop the kingdom as a fintech hub. This has instigated the growth of fintech and the adoption of digital financial services across the country. In addition, the SAMA has also granted 21 fintech companies permits to join the ‘Sandbox’, an experimental environment for fintech services. One of the largest financial institutions in the kingdom, Riyad Bank has pumped over $25 million (SAR 100 million) into its new fintech start-up program. Along with capital, the fund will also offer startups research & development support. Saudi Arabia has undertaken several initiatives to increase digitisation in financial services, incorporating its goals for the Financial Sector Development plan into its 2030 framework.

Major Fintechs in the Middle East

Saudi’s PayTabs, launched in 2014, is an online payment gateway that currently operates in Saudi Arabia, India, Philippines, Bahrain, and other GCC (Gulf Cooperation Council, – the political and economic alliance of six Middle Eastern countries—Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman) markets. It has raised over $20 million in funding and is the number one startup in terms of funding in the Middle East. It has strategic partnerships with other fintech and ecommerce companies across the globe such as Payoneer, Zoho Books, Badir Technology Incubators, and others.

Dubai-headquartered Beehive is a peer-to-peer (P2P) lending platform focused on SMEs. It uses innovative technology to connect businesses that are seeking quick and affordable capital from investors who can help fund their growth. Beehive has raised $15.5 million in funding since its launch in 2014, and is MENA’s first regulated peer-to-peer lending platform. Their partners include munchbox, Brand Creative, Duplays, EarthFood, Panache, Neutral Fuels, and others.

Another UAE-based fintech startup, Souqalmal.com is the number one financial & insurance products comparison site in the Middle East. It offers comparisons between car insurance, health insurance, travel insurance, home insurance, bike insurance, yacht insurance, as well as credit cards, bank accounts, car loans, and personal loans. Souqalmal.com offers comparisons from 3,200 retail banking, telecoms, insurance, and education products offered by various providers in the UAE and Saudi Arabia (KSA). The fintech offers customers the ability to choose between 360 credit cards, 450 bank accounts, 147 personal loans, 100 car loans, 105 mortgages, 1143 mobile phone plans, 150 broadband plans, 280 schools and 234 nurseries, and more than 100 car deals, as well as 115 SME financial products. The company has raised nearly $15 million in funding till date. Their banking partners include Emirates NBD, Abu Dhabi Finance, Arab Bank, HSBC, Mashreq, Standard Chartered, and several others while their insurance providers include the likes of Dubai Insurance, Noor Takaful, Oman Insurance, Salama, Union Insurance, and more.

Remittances in the Middle East

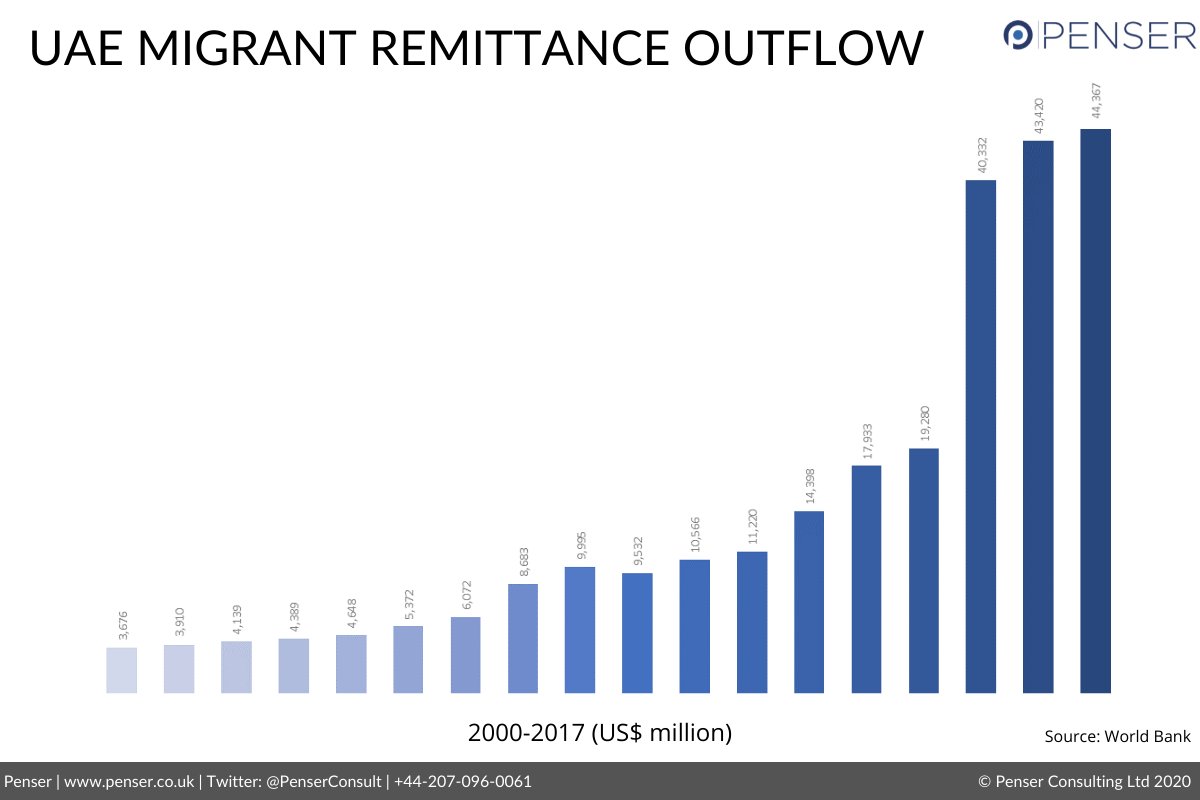

As the Middle East — particularly the GCC nations — is populated by a very large number of expats, remittances worth several billion dollars flow out every single year giving rise to a need for easier & faster payment systems with a global reach.

Money transfers from the UAE amounted to $49 billion (AED 169.2 billion) in 2018, an increase of 3% from 2017. As the cost of sending cross-border payments continues to rise, fintechs offering services that can make such payments cheaper and faster have the potential to be successful, particularly as the Middle East has always had steep charges for international payments in the past.

The Penser Perspective

As the Middle East witnesses the growth of fintech, it is important to note that the region is receiving a considerable amount of support from the governments in the form of funding, research programs, accelerator schemes, and more. KSA, Bahrain, Qatar, UAE are some of the countries in the region that have established fintech strategy programs in order to encourage increased adoption of digital services to manage finances. In fact, Saudi Arabia & Qatar have woven the development of the fintech & finance sectors into the country’s overall development framework in a bid to establish themselves as leaders in the fintech revolution in the region and develop themselves as cashless economies.

More and more residents are willing to trust companies other than their banks with their finances, leading to a rising opportunity for those fintechs that can fill the consumer’s needs. From the increasing usage of mobile wallets, online payments, digital banking, and digital investments, it is clear that users are more than willing to go digital when it comes to their finances. In fact, UAE has the highest mobile penetration rate in the world at 173%, which means residents own more than one mobile phone, and with rising internet connections, it is an opportunity that is ripe to be capitalised upon.

As expert consultants in fintech and payments, Penser closely tracks innovative developments in this sector across the globe. We offer digital transformation, growth strategy, and due diligence (both commercial and technical) services, and work with several clients based in the Middle East and other international markets.