So, now that we’ve gained an overview of traditional valuation methods, and how specific finance companies’ valuations may vary depending on metrics relevant to them, how does this work for fintech start-ups?

Fintech Start-ups Valuation 2021

Just like how we’d weigh metrics differently depending on the kind of traditional financial business model being used, fintech start-ups have specific elements that need to be considered in their valuations. Some of these qualitative factors are –

1. The nature of the solution

Does the fintech’s service offering disrupt the industry through a revolutionary solution to a major problem? Or is it just a better way of executing an existing solution? The impact of each on the market, and therefore, the start-up’s value, will vary dramatically depending on the answers.

2. TAM, SAM and SOM

Let’s start with some basic definitions:

- TAM – Total Addressable Market: The entire revenue opportunity that exists within a market for a product or service

- SAM – Serviceable Addressable Market: The part of the TAM that can be served

- SOM – Serviceable Obtainable Market: The part of the SAM that can be obtained

These metrics all relate to the scalability of the business. While traditional financial organizations, you’d need an extensive infrastructure to be set up to ensure that you can scale up to meet customer demand quickly. However, most fintechs are digital-only/mobile-first, allowing them to rapidly scale and cover a very large TAM in a relatively short period of time. Revolut had reportedly reached 7 million customers in just 5 years – a number that would have been much more difficult to attain in the non-digital world.

3. New use cases

Fintech start-ups are now finding innovative ways to provide solutions that were previously not available. For instance, low-value P2P payments, such as those facilitated by Paytm in India, or even immediate payment solutions (such as UPI in India) are now viable solution that consumers can leverage to settle smaller transactions quickly and efficiently. The start-up’s ability to provide efficient innovative solutions in new areas would impact the company’s value.

4. Lower capital expenditure and operational costs

Fintech start-ups are leaner and can expand easily without investing in infrastructure. This has allowed neobanks like Revolut, money transfer providers like TransferWise, payment solutions providers like PayPal, and more, rapidly scale and establish themselves across global markets quickly and efficiently without needing to establish physical offices first. By leveraging economies of scale, these companies are also able to keep operational expenses at a minimum, driving their profitability higher.

5. Revenue models

Fintech start-ups can leverage the network effects of their increasing number of customers, but it’s important to understand how they intend to monetize that and drive revenues. Also, as we’ve seen in an earlier post, while revenues are improving for fintech start-ups, these do not necessarily go hand-in-hand with profits. Therefore, the business should have a clear plan in place for how it will eventually grow revenue and profits.

6. Cross-selling and up-selling opportunities

Due to the inherent agility of fintech offerings today, and new opportunities that are being driven by technological innovations (machine learning, artificial intelligence, blockchain, etc.), it’s easier than ever to identify additional services that can expand the company’s offering and increase its value to the consumer. A large number of neobanks have exemplified this by moving rapidly and expanding the services they offer – most started with a single focus, and now cover current accounts, prepaid cards, and lending opportunities.

5 key valuation methods for fintech start-ups

1. The Scorecard model

The Scorecard method – initially developed by Bill Payne – introduces individually weighted percentages based on a detailed number of quantitative and qualitative factors per categories. The usual steps involved are:

- Establishing an average industry pre-money valuation benchmark by studying available industry information. This will act as the foundation for our valuation.

- Establishing individually weighted averages for key criteria, such as –

- Strength of the management team (0-30%)

- Size of the opportunity (0-25%)

- Product/technology (0-15%)

- Competitive environment (0-10%)

- Marketing/Sales channels and partners (0-10%)

- Need for additional investment (0-5%)

- Other factors (0-5%)

The weight assigned will depend on an understanding of how the company is positioned competitively; for instance, if the start-up is considered a leader, the maximum weights would be allotted.

- Then, assign comparison factors for these percentage weights. This will depend on one’s understanding of the sector and usually involves extensive research. For instance, if the company’s management team is strong, and strong teams are par for the course with successful businesses in this sector, it would be allotted a 100% comparison score.

- The last stage is then putting it all together – you multiply the weights and comparison factor, and add them all up to get the multiple value. That value is then multiplied with the industry benchmark from step 1.

So, this will eventually look something like this –

- Average industry pre-money valuation = $ 1 million

- Establish the weights for each factor (for this example, let’s assume our start-up is the industry leader, and covers all the criteria listed) =

| Condition | Weight |

| Strength of the management team (0-30%) | 0.30 |

| Size of the opportunity (0-25%) | 0.25 |

| Product/technology (0-15%) | 0.15 |

| Competitive environment (0-10%) | 0.10 |

| Marketing/Sales channels and partners (0-10%) | 0.10 |

| Need for additional investment (0-5%) | 0.05 |

| Other factors (0-5%) | 0.05 |

- Determine the comparison factor for each weight =

| Condition | Weight | Comparison |

| Strength of the management team (0-30%) | 0.30 | 1.00 |

| Size of the opportunity (0-25%) | 0.25 | 1.25 |

| Product/technology (0-15%) | 0.15 | 1.50 |

| Competitive environment (0-10%) | 0.10 | 0.80 |

| Marketing/Sales channels and partners (0-10%) | 0.10 | 1.00 |

| Need for additional investment (0-5%) | 0.05 | 1.00 |

| Other factors (0-5%) | 0.05 | 1.25 |

- Put them all together =

| Condition | Weight | Comparison | Factor = WxC |

| Strength of the management team (0-30%) | 0.30 | 1.00 | 0.30 |

| Size of the opportunity (0-25%) | 0.25 | 1.25 | 0.31 |

| Product/technology (0-15%) | 0.15 | 1.50 | 0.23 |

| Competitive environment (0-10%) | 0.10 | 0.80 | 0.08 |

| Marketing/Sales channels and partners (0-10%) | 0.10 | 1.00 | 0.10 |

| Need for additional investment (0-5%) | 0.05 | 1.00 | 0.05 |

| Other factors (0-5%) | 0.05 | 1.25 | 0.06 |

| TOTAL | 1.13 |

Multiplying this total value with the average industry pre-money valuation gives us a value of $1.13 million.

2. The Berkus method

Named after its developer, Dave Berkus, the Berkus method of valuation is a quick and easy method to value an early-stage start-up based on five parameters (listed below). Each parameter can be assigned a maximum valuation of $0.50 million, giving a maximum pre-revenue valuation of $2 million or a post-roll out value of $2.5 million.

| Condition | Max value addition ($ M) |

| Sound Idea (basic value) | 0.50 |

| Prototype (reducing technology risk) | 0.50 |

| Quality Management team (reducing execution risk) | 0.50 |

| Strategic relationships (reducing market risk) | 0.50 |

| Product roll-our or sales (reducing production risk) | 0.50 |

3. Risk Factor Summation method

As opposed to the previous two methods, the Risk Factor Summation method, considers a much broader set of factors in determining the pre-money valuation of pre-revenue companies. This method forces investors to consider 12 important factors (below), and assign a value between +2 and -2 to them. The sum of these values is then multiplied by $0.25 million and added to the average industry pre-money valuation.

The 12 factors are

- Management

- Stage of the business

- Legislation/Political risk

- Manufacturing risk

- Sales and marketing risk

- Funding/capital raising risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

What does this eventually look like? Assume that your average industry pre-money valuation is $1 million. Say, out of the 12 factors above, you assign a score of +2 to three of them, -2 to three of them, +1 to three, -1 to two, and 0 to the remaining. This gives you a net score of +1. Therefore, your pre-money valuation becomes $1 million + ((0.25) x (+1)) = $1.25 million.

4. Cost to Duplicate method

Like in the case of established businesses, if the start-up has a solution or technology or team that will be difficult to build in terms of time and money, the cost-to-duplicate method can be used to derive the company’s value. While this is similar to the Replacement Costs method we described above for established businesses, the key difference here is that the focus is not on physical assets or production capacities, but more on softer assets, such as the setup and technology team.

5. The Venture Capital method

This is an industry-standard method that looks at calculating the post-money valuation and then adjusting by ticket size and anticipated dilution. This post-money valuation is based on the terminal value divided by the anticipated ROI

If the terminal value is $1 billion, with an anticipated ROI of 25x , what this means is

Post-money valuation = $1 B / 25 = $40 million

Next, we deduct the investment amount – let’s say it’s $10 million, in this case. This gives us

Pre-money valuation = $40 million – $10 million = $30 million

If the investors expect to be diluted by 30% in the near future, then the adjusted pre-money valuation will be

Pre-money valuation (adjusted for dilution) = $30 million x 70% = $21 million

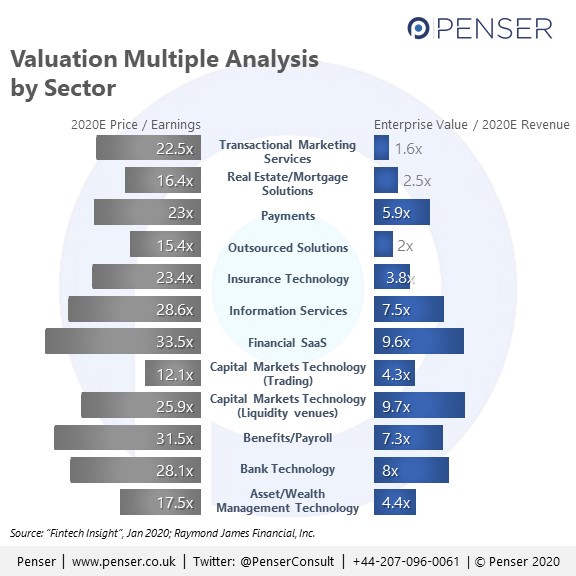

These methods allow you to make a qualitative assessment of an early-stage fintech start-up based on its vision and potential. However, potential cash flow is the key determinant of the company’s value as it grows, and therefore, as the business gets more established, the valuation process gets more scientific. A recent report shared expect valuation multiples for each sub-sector in the fintech space, which shows a wide range depending on the companies.

Penser provides expert consulting services in the payments and fintech sectors, and therefore, we pay close attention to key changes in regulations and innovations in the industry. We act as advisors to a number of financial clients on their digital transformation journeys, as well as support them with due diligence and strategic planning services. Click here to contact us for more information.