Over the last decade, the fintech industry has matured into a dynamic and increasingly multi-pronged industry. With the burst of new start-ups in the space, as well as the increasing involvement of non-finance companies (especially those in the tech sector, such as Google and Apple), fintech today has expanded to include aspects of digital banking, cross-border remittances, cybersecurity, and data management, among others. As the industry starts to make its presence felt across the technology-landscape, it’s important to have clarity on the eventual destination. In most cases, this boils down to a better understanding of what the customer’s requirements are today and will be tomorrow.

As fintech consultants and payments experts, Penser focuses on key trends in the fintech space, and understanding how key players in the industry are adapting to changing requirements. Here are some of the customer trends that we have seen gaining momentum in the last year, and that we expect to define fintech in the near future:

1. The expansion of the fintech business model into an ecosystem that includes non-financial vendors

As we loosely touched upon above, fintech is fast becoming enmeshed in consumers’ lives in several ways – both expected and unexpected. With online payments and digital transactions becoming a bigger part of the average consumer’s day, the expectations of a frictionless experience multiply. Consumers today expect service providers to ensure simplicity, consistency and security across the spectrum. Due to this, the reputations of fintech service providers are closely tied to their vendors and partners, and both are equally impacted by any adverse experiences. Therefore, we are likely to see tighter integrations and more customized white-label solutions that blur the lines between client, consumer and vendor, allowing for more seamless experiences. If you consider fintech start-ups that provide solutions as a service, there have already been a number of companies that have cropped up in recent years. For instance, Synapse provides banking-as-a-service solutions, where they allow you to build the financial instruments you need; they also recently raised $33 million in their Series B round. Or Plaid, which enables you to easily integrate with other service providers, and was recently acquired by Visa for $5.3 billion. And non-financial players have also started to expand into fintech – companies like Shopify, which provides website services, or MindBody, a company that helps fitness studios manage their business, have both generated almost half their revenue from the financial services they provide.

2. Personalised experiences through unbundled/re-bundled services

Bespoke solutions are quickly becoming the norm, not the exception. After having survived traditional banking’s one-size-fits-all approach to services, consumers today are seeing the benefits of the agile tailored solutions that fintech start-ups offer. Customers – of both B2B and B2C service providers – now demand an experience that suits their needs and are willing to pay a premium for it. Fintech service providers have to now work towards a ‘segment of one’ approach towards solutions that both blend strategies and channels in order to increase lifetime values.

One specific sector where there has been a lot of activity lately is in payroll. Start-ups today are disrupting the traditional model. Companies such as Earnin provide customers access to advances on their salaries, while apps like Even also integrate financial planning services along with the advances. By restructuring how this works, these companies allow customers greater control over their income and finances.

3. Willingness to exchange personal data for improved services and guidance

While personal data is sacrosanct, and the regulations that safeguard them becoming more stringent, customers are increasingly seeing the advantage of willingly sharing their information in exchange for personalised services and financial advice. Modern fintech service providers are now able to leverage technology, such as AI, machine learning and more – to better understand what microsegments of consumers need and provide insightful and meaningful advice in real-time. This provision of genuine value tailored to each customer’s individual behaviour justifies the use of their personal data, which in turn will allow companies to develop deeper relationships with them. One of the first to recognize this trend and act on it was the Citi group -back in 2018, they opened their iPhone app to non-customers, allowing them to create a profile and get 360-degree insights on their financial accounts. This, along with other innovative features, led to a 25% increase in app customers from Q1 2017 to Q1 2018.

4. A better balance between automated and human advisors

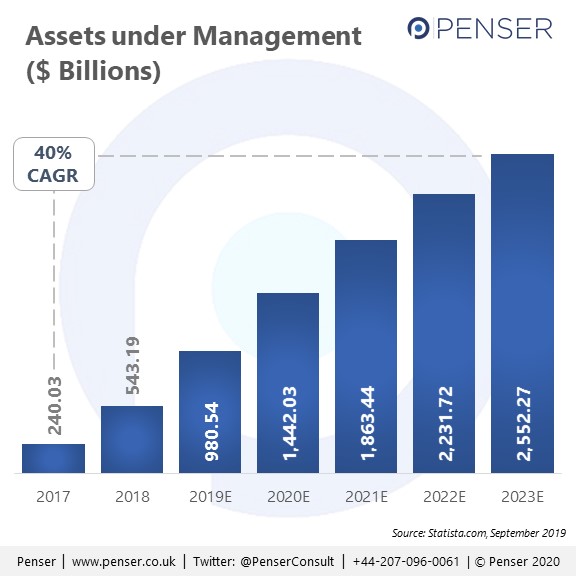

Customers today still appreciate the value of interacting with a real person when it comes to addressing their financial needs. However, utilising automated support, such as robo-advisors or AI-based virtual assistants, can still help improve the customer experience. This is because they would free up human advisors from answering simple transactional inquiries and allow them to generate more value in each interaction. Finding the right balance between machine-based solutions and human advisors would therefore be a key area that service providers will be looking to prove themselves. Robo-advisors is already a rapidly-growing segment with a CAGR of 27%, and is expected to cross $2.5 trillion assets under management by 2023, and more companies are investing in this spce. As recently as last month, Grab, the southeast Asia “super app”, acquired Bento Invest, a Singapore-based robo-advisory start-up for an undisclosed value.

Two of the key robo-advisors in the market – Betterment and Wealthfront – make it easier for customers to access their services by not requiring an account minimum, and have been raising funds successfully from investors. Betterment has raised $275 million over its 7 funding rounds, while Wealthfront has raised over $200 million in its 6. SigFig, another robo-advisory investment service, has built their entire business model around this trend – they provide customers with accounts that exceed $10,000 access to human advisory firms for free.

5. Building loyalty across all touchpoints

Aside from ensuring that the customer experience is seamless and consistent, fintech service providers are under increased pressure to ensure that their data is secure, and fraud is prevented. The customer experience is no longer siloed and limited to traditional financial channels with customers now expecting the same level of security across their digital and physical interactions. Moreover, with the ever-increasing number of options available to them, customer loyalty must be earned and nurtured.

MoneyLion, the lending start-up, approaches loyalty-building through a rewards program. By rewarding users with points for saving money and improving their credit that can then be redeemed for gift cards at select companies, they encourage customers to engage more often with their money and the MoneyLion app. This, in collaboration with partners like Button and their online cashback offerings, they’re merging the online shopping experience with their financial services app, reinforcing the trust customers have in them through repeated interactions.

These 5 key aspects of the fintech industry have gained considerable momentum recently, and are likely to become more prominent in the near future. However, these are not the only trends to pay attention to. As experts in the payments and fintech sectors, Penser provides both wider and deeper insights into key trends in the fintech space to our clients. With over a decade of experience in the industry, we have gained depth and insight into what our clients’ customers expect. We act as advisors to a number of financial clients on their digital transformation journeys, as well as support them with due diligence and strategic planning services. Click here to contact us for more information.