Due diligence is an important step to ensure a profitable business deal. Regardless of whether it is a merger or acquisition, business purchase or sell-off, or venture capital (VC)/private equity (PE) funding. Due diligence becomes all the more necessary if the deal involves a startup.

Unlike well-established businesses, start-ups do not have significant historical financial data that can help determine the true value of the business. Therefore, making investing in a start-up riskier than investing in an established business.

To assure a successful due diligence process, here are few key points to keep in mind:

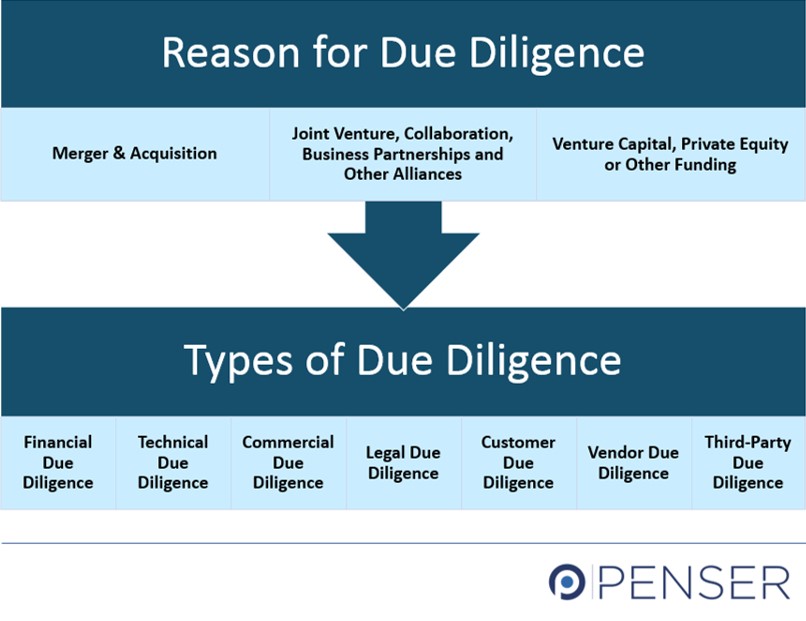

Determine The Reason for Due Diligence

Due diligence is a process carried out by companies before buying, acquiring, selling, or investing in another business. The process involves investigating the concerned company’s financials, legal situation, product, goals, strategy, and other such aspects. This helps confirm if everything is correct and in place to estimate the financial value of the company and also to ensure smooth execution of the takeover, merger, or investment.

Identifying the reason for due diligence helps in finalizing the due diligence process and selecting a due diligence specialist with expertise in the associated sector. For example, Penser provides due diligence service to companies in the financial technology (fintech) and digital payments sectors.

Some of the common reasons for due diligence are:

Mergers and Acquisitions (M&A)

In the case of M&A, due diligence should be carried out by both – the seller and the acquirer. The acquirer’s focus is usually on the current position of the company from financial, legal, technical, and other viewpoints. While the seller’s focus is on the acquirer’s/buyer’s market position and financial stability.

Joint Ventures, Collaborations, and Other Partnerships

Due diligence is equally important while collaborating with other businesses. These days many companies are entering into agreements with other companies to provide holistic solutions to consumers. For example, financial companies tying up with technological companies. It is an easy way to diversify a business’s services or products portfolio. Both the companies, in this case, should carry out proper due diligence regarding the financials, products and/or services, public or any legal issues, any existing agreements, and other relevant information.

Venture Capital, Private Equity or Other Monetary Investment

While investing in a start-up, it is important to conduct due diligence before finalizing the investment amount. The key factors to consider in VC/PE due diligence are the product/solution, existing market, consumers, cash flow situation, and the team. Even start-ups looking for VC and PE funding should conduct due diligence before reaching out to investors. This ensures that they are reaching out to the right investors and improving their chances of receiving funds. For example, a fintech company should usually look for investors who have an interest and knowledge about fintech sector.

Due Diligence checklist for VC Investors

Types of Due Diligence, and their Importance

Now that the reason for due diligence is determined, it is important to be informed about the types of due diligence conducted by companies.

Financial Due Diligence

In financial due diligence, the company’s historical financial data is analyzed. This is done to identify any potential risks, determine the company’s current financial status, and forecast future income from the business.

Technical Due Diligence

This involves reviewing a company’s information technology (IT) infrastructure. Due diligence professionals analyze existing software licenses, network security and sensitivity, data management, and potential risks. Proper due diligence also helps answer additional capital requirements to improve the existing IT infrastructure.

Technical Due Diligence Checklist

Commercial Due Diligence (DD)

Commercial due diligence provides an overview of a company’s surrounding environment. Sometimes addressed as market due diligence. As the name suggests, it is carried out to determine the company’s existing market position, growth potential, etc. Due diligence experts look into the business plan, goals, customer base, market trends, and other internal and external factors to ensure a company’s long-term feasibility. Commercial due diligence is usually carried out by VCs and PE before funding the company. Learn more about the questions to ask during commercial due diligence.

Commercial Due Diligence Checklist

Legal Due Diligence (DD)

Legal due diligence is a complex and time-consuming process. Time-consuming since it is dependent on external sources such as the Ministry of corporate affairs, or other regulatory authorities associated with the formation of companies. Every news does not reach the public platforms. A company could be facing lawsuits, there could be pending agreements or agreements that may not be beneficial from a long-term standpoint. Legal experts will reach out to government authorities to confirm the authenticity of the Memorandum of Association, Articles of Association, Licensing and partnership agreements, loan and other financial agreements with banks or private fund-raising companies or investors, lawsuits, existing or pending cases. Carrying out legal due diligence can help avoid future unforeseen but preventable problems.

Customer Due Diligence (DD)

If your business enters into an agreement to provide services to another company, it is important to carry out customer or client due diligence. Customer/Client due diligence is important to determine whether the company is authentic, and not involved in any malpractices, such as money laundering, human trafficking, or funding any terrorist group. Even if the situation may not be so drastic, it helps with concluding that the client has a good reputation and is financially stable.

Vendor Due Diligence (DD)

Vendor due diligence, also known as ‘sell-side due diligence, is requested by a selling company. They hire an independent third party to conduct the due diligence to ensure a non-biased due diligence report. A vendor DD helps determine the true value of the selling company based on its financial situation, product/service strength, and market position. This enables the selling company to support its quoted price.

Third-Party Due Diligence

In case of a company is looking to partner with a service provider or has decided to outsource some of the business processes, due diligence of the third party becomes an important step to finalize the right company for this service.

Due diligence is not an easy process and to ensure a complete, flawless due diligence execution it is best practice to rely on professionals.

Why hire a Due Diligence Professional?

It may look easy to carry out a due diligence process, after all, most of the information is available online. But the key difference here is that practice makes perfect. Consulting companies conduct due diligence regularly. What may miss your eyes, an expert will surely be able to spot. They are aware of the usual red flags, unnoticeable errors, or issues. Another reason to reach out to professionals is – time limit. A proper and complete due diligence process takes time, unpredictable events can lead to further delays. Hiring professionals can help meet deadlines and avoid unnecessary delays. Improper due diligence can result in the acquisition of a liability instead of an asset.

About Penser, Fintech & Payments Expert

Penser is a UK-based fintech and payments consulting firm, with more than a decade of experience. We have the required expertise and skillset needed to carry out the various types of due diligence processes required in a fintech merger and acquisition, alliance, or sell-off.

If you need assistance with the valuation of your company or looking forward to a merger or buying a new business or transforming your business digitally, Penser’s consulting service could be useful in more than one way.

Learn more about Penser’s services. Contact us at hello@penser.co.uk regarding your queries, and have one of our team members reach out to you.